The Best Strategy To Use For Top 30 Forex Brokers

10 Simple Techniques For Top 30 Forex Brokers

Table of ContentsMore About Top 30 Forex BrokersTop 30 Forex Brokers Things To Know Before You Get ThisAbout Top 30 Forex BrokersNot known Facts About Top 30 Forex BrokersThe Main Principles Of Top 30 Forex Brokers Top 30 Forex Brokers Can Be Fun For EveryoneAn Unbiased View of Top 30 Forex BrokersHow Top 30 Forex Brokers can Save You Time, Stress, and Money.

Like various other circumstances in which they are made use of, bar graphes offer more cost info than line graphes. Each bar graph represents eventually of trading and has the opening rate, highest possible price, least expensive rate, and shutting cost (OHLC) for a trade. A dash on the left represents the day's opening rate, and a comparable one on the right represents the closing price.Bar graphes for currency trading assistance traders identify whether it is a customer's or vendor's market. Japanese rice traders first utilized candlestick graphes in the 18th century. They are aesthetically more enticing and easier to review than the chart kinds explained above. The top part of a candle light is used for the opening cost and greatest cost point of a money, while the lower part shows the closing cost and cheapest rate point.

Not known Factual Statements About Top 30 Forex Brokers

The developments and shapes in candlestick charts are made use of to determine market instructions and activity.

Financial institutions, brokers, and dealerships in the foreign exchange markets enable a high amount of take advantage of, suggesting investors can regulate huge positions with relatively little cash. Utilize in the variety of 50:1 prevails in foreign exchange, though also higher quantities of utilize are readily available from certain brokers. Nevertheless, leverage needs to be utilized carefully since numerous inexperienced investors have suffered substantial losses making use of more leverage than was essential or prudent.

The Single Strategy To Use For Top 30 Forex Brokers

A currency investor needs to have a big-picture understanding of the economies of the different countries and their interconnectedness to realize the basics that drive money worths. The decentralized nature of forex markets indicates it is much less regulated than other financial markets. The extent and nature of law in forex markets rely on the trading territory.

The volatility of a particular currency is a function of several factors, such as the national politics and business economics of its nation. Events like economic instability in the type of a repayment default or discrepancy in trading connections with one more currency can result in substantial volatility.

About Top 30 Forex Brokers

The Financial Conduct Authority (https://www.avitop.com/cs/members/top30forexbs.aspx) (FCA) displays and controls foreign exchange trades in the UK. Money with high liquidity have a ready market and show smooth and predictable cost activity in action to external occasions. The united state dollar is the most traded money on the planet. It is paired in 6 of the marketplace's seven most liquid money sets.

Not known Facts About Top 30 Forex Brokers

In today's information superhighway the Forex market is no more entirely for the institutional financier. The last 10 years have actually seen a boost in non-institutional investors accessing the Foreign exchange market and the advantages it supplies. Trading platforms such as Meta, Estimates Meta, Trader have actually been created particularly for the personal investor and educational product has actually become quicker offered.

Not known Facts About Top 30 Forex Brokers

Foreign exchange trading (foreign exchange trading) is a global market for purchasing and offering money - AVATRADE. 6 trillion, it is 25 times bigger than all the globe's supply markets. As an outcome, prices change continuously for the currencies that Americans are most likely to make use of.

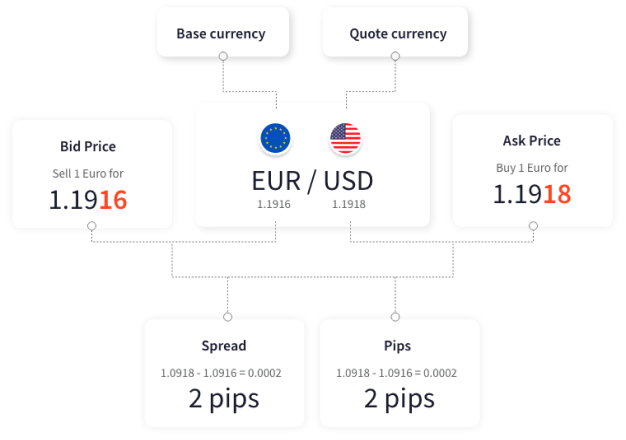

When you sell your currency, you receive the settlement in a various currency. Every traveler that has obtained foreign money has done forex trading. The investor purchases a particular money at the buy cost from the market maker and sells a different money at the selling cost.

This is the transaction expense to the investor, which subsequently is the profit earned by the market maker. You paid this spread without realizing it when you traded your dollars for foreign currency. You would certainly discover it if you made the purchase, canceled your journey, and afterwards tried to trade the currency back to bucks as soon as possible.

8 Simple Techniques For Top 30 Forex Brokers

You do this when you visit this page believe the money's worth will fall in the future. Services short a currency to protect themselves from threat. Shorting is extremely dangerous. If the money rises in worth, you have to get it from the dealer at that cost. It has the exact same pros and cons as short-selling stocks.